UHC in small island developing states

Small island developing states have many vulnerabilities, not least in their supply chains. From the food that is consumed to the resources required to keep 65 million people healthy, the challenges are truly unique

By T. Alafia Samuels, Caribbean Institute for Health Research, University of the West Indies

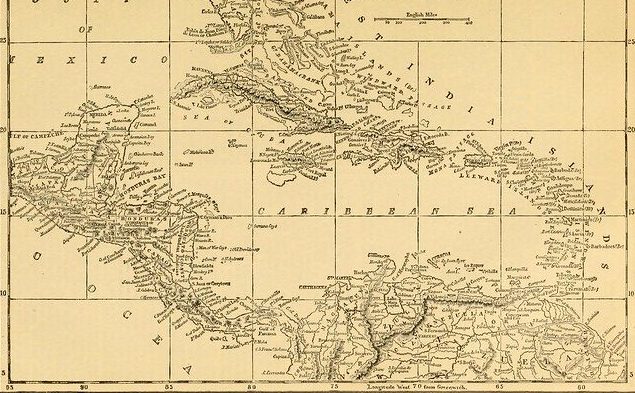

Among the 30 small island developing states in the Caribbean and 21 in the Pacific, population size varies from 11.5 million in Cuba to 1,500 in Niue. The 58 SIDS globally have a combined population of 65 million; 38 are independent member states of the United Nations, and 20 are still colonies. Two-thirds are high or upper middle income states.

Despite their wide geographic spread, SIDS face similar challenges regardless of their income status. They are vulnerable to global economic shocks and to natural disasters and are on the front line of the impact of climate change. Their small, vulnerable economies, dependent on a few industries such as tourism, struggle with a limited and unstable tax base and a disproportionate burden of the public administration required for an independent nation-state. Their remote locations mean high costs for communications, energy and transportation, and economies that are not diversified means

dependence on imports. St Kitts and Nevis import 95% of what they eat.

Burden in SIDS

As a group, SIDS have a disproportionate burden of non-communicable diseases – risk factors, morbidity, mortality and, most important, premature mortality. In both Guyana and Fiji, 31% of those aged 30 will die from an NCD before their 70th birthday, compared to Canada at 10%. The top 10 most obese countries in the world are all Pacific Islands. While the global prevalence of diabetes is 8%, in SIDS the diabetes prevalence is around 20% and diabetes-related mortality is three times higher than the global rate.

Health systems response

SIDS health systems are under-resourced and struggling to transition to a chronic care model to reflect the epidemiological transition from communicable to non-communicable diseases.

Small markets, high transport costs and lack of economies of scale for negotiating better deals for drugs and medical technology result in high, variable prices. The price of Simvastatin to treat high cholesterol varies tenfold between Nauru and the Cook Islands. Universal health coverage is ideal and appropriate funding arrangements need to be put in place, most obviously in the form of national health insurance schemes.

In the Caribbean, both primary and hospital health services are mostly free at the point of delivery, but inadequate human, financial and organisational resources limit the quality and quantity of services delivered. Several Caribbean countries are actively considering introducing a national health insurance scheme, but in these small islands, several concerns need to be considered.

Population ageing in the Caribbean and the rapid increase of NCD risk factors mean that within 15 or 20 years, the demands for services will likely double.

Public expectations of the benefit package will be driven by the medical dramas and advertisements on North American cable television. US media penetration of the region is complete, since small populations cannot generate sufficient local content, and social media is ubiquitous.

Small populations can neither train nor generate sufficient demand for the full spectrum of sub-specialties, so that, for example, none of the smaller islands will have a paediatric orthopaedic oncologist. Such specialised care will need to be sought overseas and the national health insurance scheme will need to determine how much overseas care it can support.

Among health professionals on the islands, the brain drain is acute. Barbados, a country of fewer than 300,000 people, lost 51 registered nurses in January 2019 to recruiters from the United Kingdom.

Health information systems are weak, underdeveloped and fragmented. There is a history of systems being installed that cannot be queried and serve poorly the needs of NCD care.

Travel back and forth between SIDS and high-income settings is very common and has contributed to the ‘westernisation’ of the Caribbean diet. Marketing and sales by ‘Big Food’ and ‘Big Drink’ transnational companies have aggressively targeted those SIDS that have high disposable income – and the World Bank classifies 10 of the 20 countries in the Caribbean Community as high income.

Travel back and forth between SIDS and high-income settings is very common and has contributed to the ‘westernisation’ of the Caribbean diet. Marketing and sales by ‘Big Food’ and ‘Big Drink’ transnational companies have aggressively targeted those SIDS that have high disposable income – and the World Bank classifies 10 of the 20 countries in the Caribbean Community as high income.

Despite these challenges, some countries have already instituted specific initiatives to improve patient access to chronic disease care. Trinidad and Tobago’s Chronic Disease Assistance Programme and the Jamaica Drugs for the Elderly Programme both provide extra support for purchase of a defined list of medications for chronic conditions. In Antigua and Barbuda, the Medical Benefits Scheme provides a suite of services to its members.

The heads of government and ministers of health in the Caribbean are committed to enhancing their populations’ access to quality care. The challenge is how to pay for it. As one Jamaican prime minister famously declared, “It takes cash to care.”

Bermuda recently introduced a 50% tax on sugar and sugar-sweetened beverages, concomitant with subsidies for healthy foods. In Barbados, a 10% tax on sugar and sugar-sweetened beverages has seen a 4% decline in consumption and 8% increase in the sale of water.

Dominica’s tax on sugar was to be evaluated, but then came island-wide devastation from Tropical Storm Erika in 2015, followed two years later by Category 5 Hurricane Maria. Other Caribbean islands are actively considering taxing sugar-sweetened beverages. Several countries in the Pacific have implemented such taxes, including Fiji, Tonga and Vanuatu.

This is a good solution. Taxes on sugar and sugar-sweetened beverages and on ultra-processed and unhealthy fast food can be framed as a health levy – prepayment on the cost of treating the diseases that will result from their consumption. These taxes will generate a steady stream of funds to support universal health coverage.

Jamaica already earmarks taxes from tobacco and alcohol for the National Health Fund.

In the face of free trade and aggressive marketing of ultra-processed food and sugar drinks, which are driving the change in food culture and the tsunami of premature mortality from NCDs, the options open to governments include fiscal, regulatory and legislative measures. Small islands have limited human resources to generate their own legislative measures and are often reluctant to adopt ‘model legislation’ from elsewhere. Earmarked taxes appear to be more feasible and effective in both reducing risk and as an easy source of funding for universal health coverage.